DashDocs.AI

Focus on your core business and make the best of it!

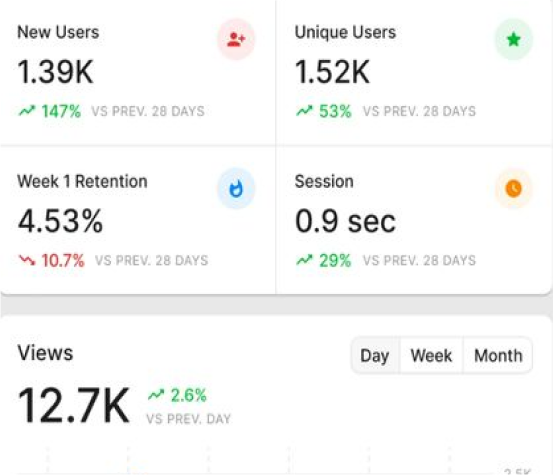

Accurate and real time financial information is very important for running a successful business.

With DashDocs.AI you exploit the latest technology to serve your purpose.

All you need to do is submit the needed material and your accountant will take care of the rest.

(When needed our polite and kind assistants will contact you – but only when needed!)

Feature List

Features and functionalities

State of the art image processing

Our advanced image processing straightens wrinkled receipts and can interpret data row by row ensuring high quality documents and data.

Submit a picture of PDF to DashDocs.AI

You may download any picture or electronic document to the application. Your assistant will analyze it and send it to your accountant.

Document archive

Browse and check all your documents from the document archive. The archive has a comprehensive log including time stamps, file formats and user log to ensure 100% transparency and efficiency.

Intelligent

data request

In case we don’t have the needed information to complete the accounting your assistant will ask detailed questions with predefined choices for the remaining needed pieces of data. Our system is a learning system so the number of requests decreases in time.

Automated

reconciliation

All transactions and bank accounts are automatically reconciled. Real time banking information from multiple bank accounts ensures a fast and efficient process.

We integrate to the banking systems using the PSD2 interface.

Two step

authentication

The two step authentication process ensures that only the authorised individuals can enter and see your financial data.

Security level set to match high level banking standards.

Feature List

Accounting Office Integration

- Full access to modify and adjust underlying AI-flows of customers

- Chat with mobile-app user

- Integration to mainstream Accounting Software Platforms

Seamless Integration with Financial Systems

- ERP and CRM Integration: Sync with platforms like SAP, QuickBooks, and Salesforce

- API Access: Customize your workflows through developer-friendly APIs.

- Multi-Channel Data Sync: Work with data across multiple formats and sources.

How does it work?

No jargon – keep it simple!

No jargon – keep it simple!

Works in any industry – you set the context

Works in any industry – you set the context

Benefit from the latest AI technology

Benefit from the latest AI technology

Benefit from the latest AI technology

Benefit from the latest AI technology

Testimonials

User stories

Lisa, a busy executive at a mid-sized company, needs to manage financial reports and keep track of company expenses efficiently.

She uses our solution to easily submit receipts and financial documents directly to her accounting team. The AI asks relevant questions on the spot, ensuring no information is missing.

This gives Lisa confidence that everything is processed accurately and on time, freeing up her schedule for high-level decision-making.

Lisa

Sarah runs her own small design business. Between client meetings and project deadlines, managing receipts and invoices is time-consuming and often pushed to the last minute.

With our solution, Sarah snaps a quick photo of receipts, uploads invoices, and answers simple AI-driven questions to ensure all necessary details are captured.

This seamless process helps her stay on top of bookkeeping, so she can focus on growing her business instead of worrying about paperwork.

Sarah

Mark handles several key accounts for a growing tech firm. He’s constantly traveling and managing multiple projects, which leaves little time for admin tasks.

Our app allows him to instantly upload expense receipts and invoices from his phone, while the AI ensures all relevant information is gathered upfront.

This automated system means Mark no longer has to follow up with his accountant for missing details, keeping his accounts in perfect order without added effort.

Mark

Our Collaborators